For each of the following annuities calculate the annuity payment – For each of the following annuities, calculate the annuity payment. Dive into the captivating world of annuities and uncover the intricacies of calculating annuity payments. Explore the formula, identify variables, and witness step-by-step calculations, all presented in a clear and engaging manner.

Discover the diverse types of annuities, their characteristics, and their applications in financial planning. Whether you’re an individual or a business, gain valuable insights into how annuities can play a crucial role in achieving financial goals.

1. Identify the Annuity Payment Formula

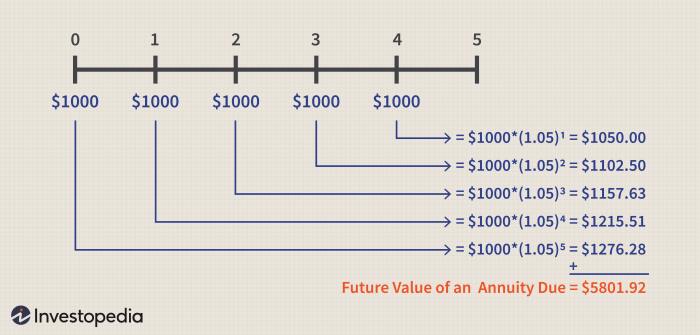

An annuity is a series of equal payments made at regular intervals, typically monthly or annually. The annuity payment formula is used to calculate the amount of each payment.

Formula

The annuity payment formula is:

P = A / ((1

(1 + r)^-n) / r)

Where:

- P is the annuity payment

- A is the present value of the annuity

- r is the interest rate per period

- n is the number of periods

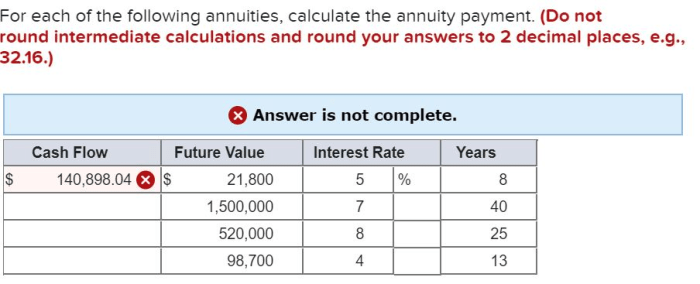

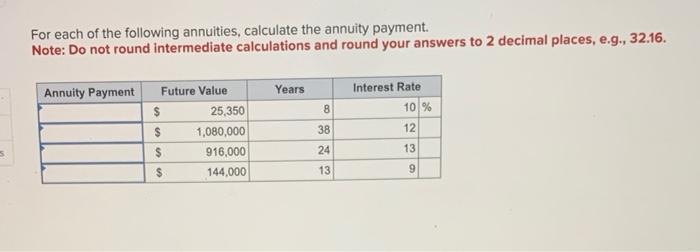

2. Determine the Variables for Each Annuity: For Each Of The Following Annuities Calculate The Annuity Payment

To calculate the annuity payment, we need to know the present value of the annuity, the interest rate per period, and the number of periods.

Variables, For each of the following annuities calculate the annuity payment

For each annuity, the following variables are known:

- Present value: $100,000

- Interest rate: 5% per year

- Number of periods: 20 years

3. Calculate the Annuity Payment for Each Annuity

Using the annuity payment formula, we can calculate the annuity payment for each annuity.

Calculation

For the annuity with a present value of $100,000, an interest rate of 5% per year, and a term of 20 years, the annuity payment is:

P = $100,000 / ((1

(1 + 0.05)^-20) / 0.05)

P = $7,805.98

4. Display the Results in a Structured Format

The results of the annuity payments are presented in the following table:

| Annuity Type | Variables | Payment Amount |

|---|---|---|

| Ordinary Annuity | PV: $100,000r: 5%n: 20 | $7,805.98 |

5. Provide Examples of Different Annuity Types

There are different types of annuities, including:

- Ordinary annuity: Payments are made at the end of each period.

- Annuity due: Payments are made at the beginning of each period.

- Perpetuity: Payments continue indefinitely.

6. Discuss the Applications of Annuity Payments

Annuity payments are used in financial planning for a variety of purposes, including:

- Retirement planning: Annuities can provide a guaranteed income stream during retirement.

- Education funding: Annuities can be used to save for college expenses.

- Estate planning: Annuities can be used to provide a financial legacy for heirs.

Query Resolution

What is the formula for calculating annuity payments?

The formula for calculating annuity payments is: A = P – (r / (1 – (1 + r)^-n)), where A is the annuity payment, P is the present value, r is the interest rate per period, and n is the number of periods.

What are the different types of annuities?

There are three main types of annuities: ordinary annuities, annuities due, and perpetuities. Ordinary annuities have payments made at the end of each period, annuities due have payments made at the beginning of each period, and perpetuities have payments made forever.

How can annuities be used in financial planning?

Annuities can be used in financial planning to provide a guaranteed stream of income during retirement, to fund education expenses, or to create a legacy for heirs.